Three of the ‘big 4’ banks in Australia have today announced they are working together on a new cross platform mobile wallet for use in Australia.

Westpac, Commonwealth Bank and National Australia Bank are the source of the new app, called Beem with the aim to enable instant payments from person-to-person, or person to small business owners. Even with the three banks pushing the service, users of Beem won’t even need to be customers of CBA, Westpac or NAB.

It’s a personal app rather than a payment solution aimed at replacing the tap and pay solution that currently headline the banks mobile wallet offerings. At launch, customers using Beem will be able to send a maximum of $200 per day and receive a maximum of $10,000 per month which the conglomerate describe as ‘an initial risk control measure’.

Beem will be aimed at making things like splitting bills easy, or even allowing small business owners without EFTPOS facilities to take digital payments.

NAB Chief Operating Officer, Antony Cahill, said the bank is continually looking for opportunities to make banking easier, simpler, and more convenient for its customers, both consumers and businesses.

It will be secure, with the banks promising that Beem will have ‘bank level security’ as well as encrypting user account information. Additionally every transaction will be authenticated and subject to real-time fraud monitoring.

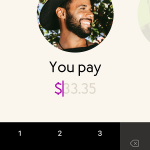

The mobile wallet will be cross platform with both Android and iOS apps being made available. Screenshots of the app were shared as well:

Commonwealth Bank will be starting user testing of a Beem prototype app later this year. No details on how users will be chosen has been announced.

Do you see yourself using Beem?