Now, I should preface this by saying I’ve had an Up account for over a year, but that doesn’t really matter much – signing up for an Up bank account takes minutes, and your account (and virtual debit card) are enabled within those minutes, so you too can switch your banking in less than an hour.

Why would I want to switch?

I’ve long thought that the Big 4 banks are the dinosaurs of our society – they’re slow to catch up with modern technology, and when they do, they often don’t get it right. ANZ’s mobile app is great, but there’s so many things it doesn’t let you do – manage your PayID, manage upcoming payments, etc. Plus, the Voice ID thing is horribly annoying – this morning I tried to transfer some money between my own accounts, and I couldn’t because Voice ID couldn’t identify me in a noisy environment. How ridiculous.

It was the last straw, and I decided to move everything to Up. If you’d like to sign up to up with a $10 bonus to get you started, click here and use Ausdroid’s referral code. We don’t get paid, but you do, so you’ve got nothing to lose!

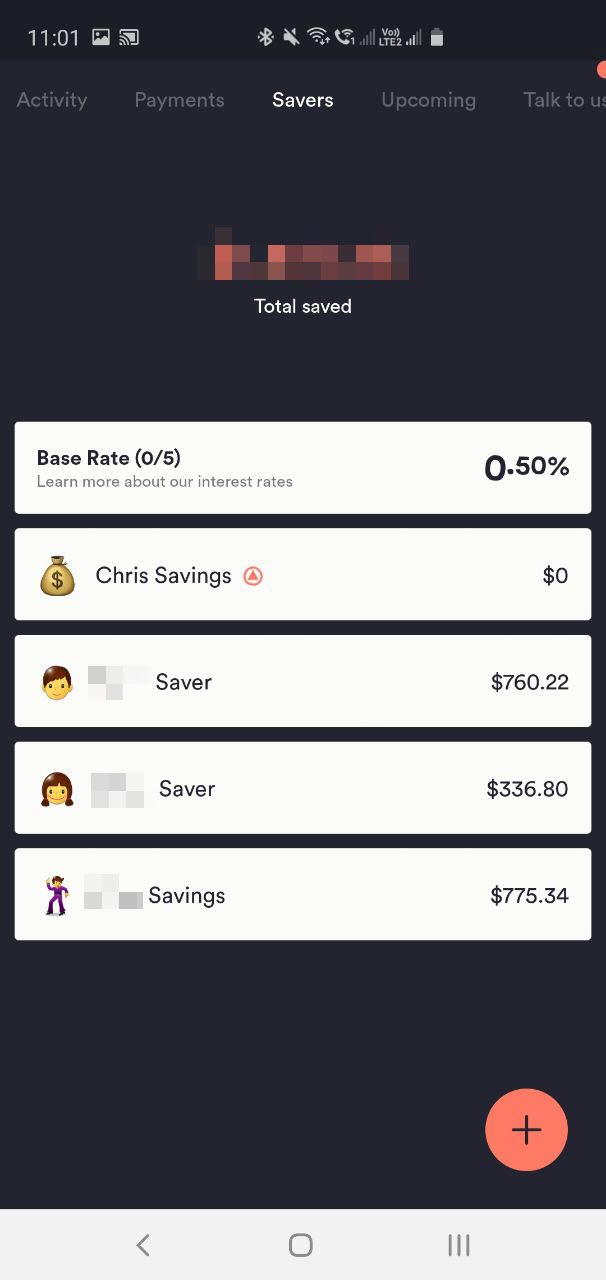

By contrast to ANZ, Up offers everything I want – I can enable/disable PayID in app, I can see and manage future transfers, I can easily create new savings buckets and move money around instantly. I get notifications when money hits my account, when payments are processed, and – when I give my card to others to go buy coffee / food / etc – I can see when my card is used.

There’s also no stupid (and superfluous) security protocols either. Identify with a PIN or a fingerprint, and you can move your money around. Sorry ANZ, it was the straw that broke the camels back!

So, how easy is it to switch? Very!

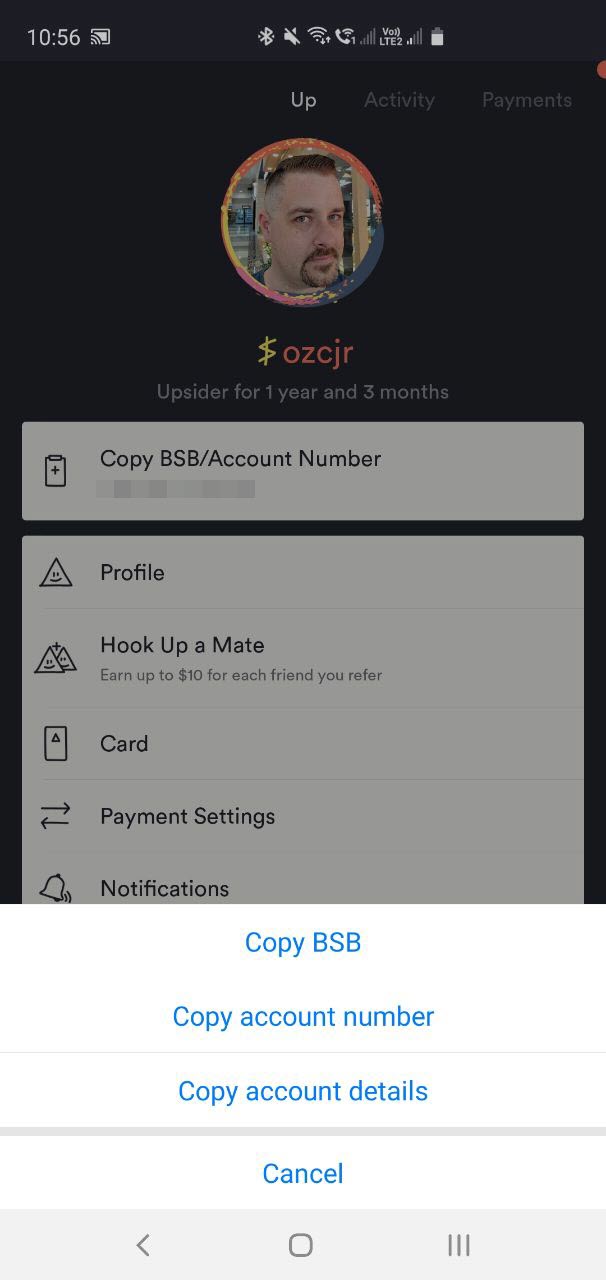

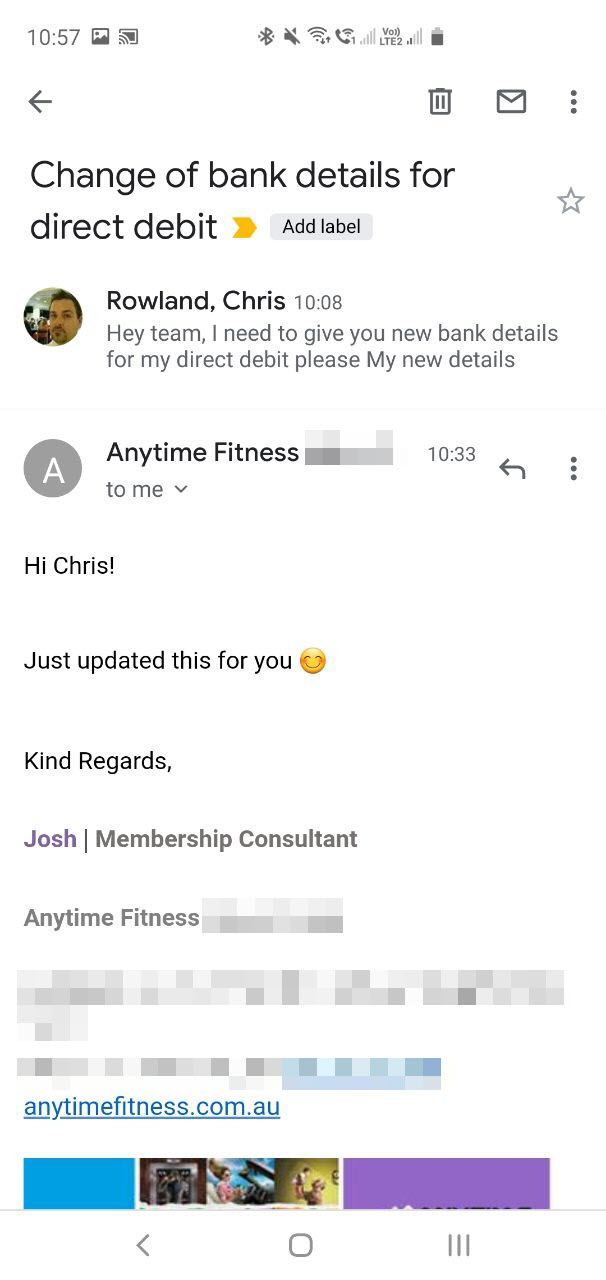

First up, Up copies your account details to your clipboard so you can email them around easily – so advising my gym (my only direct debit) and my employer (for salary / expenses) of new bank details is super easy! Better yet, the gym responded within 20 minutes.

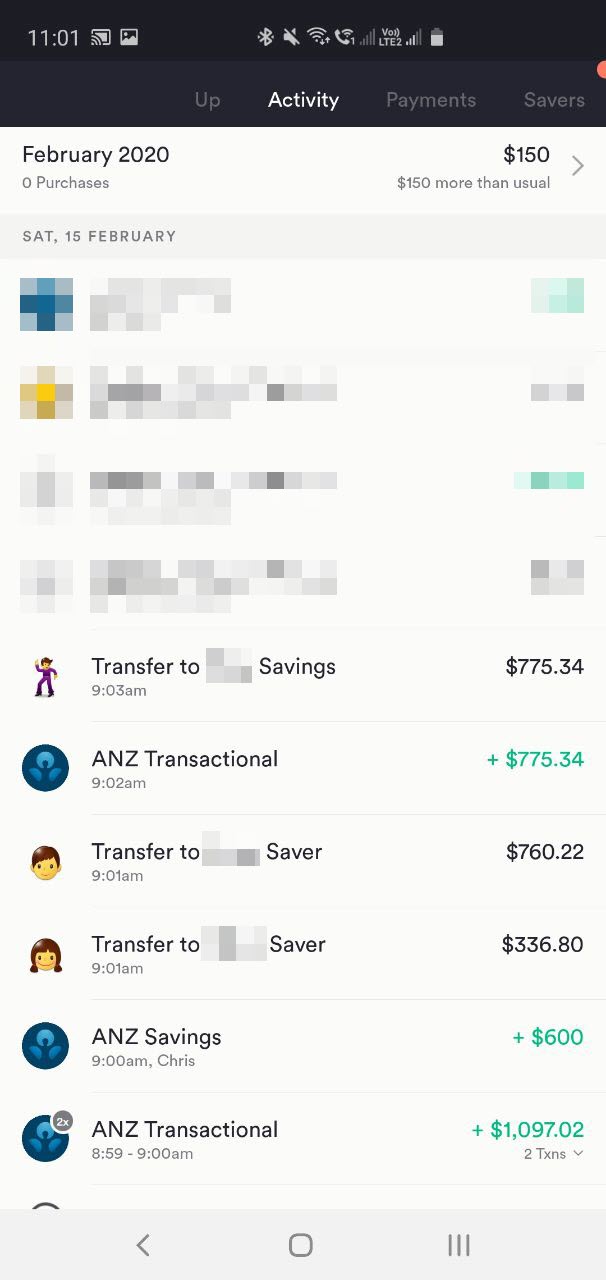

Moving your money from your existing accounts is easy too. In my case, I’ve got my transaction account, my savings, and a savings account for each of the kids. Because Up creates an automatic Pay ID for your account (you can add your own, but the auto one is easy), transferring my money from ANZ to Up took just a couple of minutes – just use the auto Pay ID, tap in the account balance to transfer the lot, and it appeared in Up in seconds:

Once that was done, the only thing left was to set up my automatic transfers from my salary. This took a little longer, as I had to do them one at a time with my ANZ future transactions open on my laptop, so I could type them into the Up app.

This was a slight pain point, because (a) ANZ’s mobile app doesn’t let you view future transactions, so I had to use a laptop, and (b) Up doesn’t have a web app, so I couldn’t copy from one browser window to another. However, a browser-based Up app is coming so that you can use things other than your phone … we just have to wait.

Setting up the future transactions wasn’t too hard though, and now I can see the upcoming list in-app, too.

Obviously, your transfer from a Big 4 bank to a digital-first bank like Up might take longer, especially if you have a lot of direct debits to identify and move. I’ve been quite strong in my resolve to avoid having any direct debits (I’d rather schedule payments than have someone else ‘take’ them), so for me this isn’t really an issue.

The only other downside to Up (pardon the pun) is they have no credit products yet, so if you need/have a credit card, you’ll have to leave that with whatever bank you use. In my case, I’ll keep ANZ’s low rate (and fee free) credit card for now, even though I rarely use it.

https://play.google.com/store/apps/details?id=au.com.up.money&hl=en_AU

Have you recently moved your banking from a Big 4 bank to a digital bank? What was your experience?