Investments have always had an air of old-school money to them, they inspire images of old men in wood panelled rooms sipping scotch, smoking cigars and making backroom deals. While that’s nothing really like what goes on, it’s an image that stops a lot of people entering into investing their money, but a new Australian startup called First Step wants to change this image and bring investing to everyone.

The idea is simple, use micro payments from your bank account to slowly build capital in an investment fund. Sound familiar? It’s very much like the service offered by micro-investments platform Acorns. You link your account and the service rounds up to the nearest whole dollar and then extracts a small amount from your account, investing a couple of dollars at a time.

Sounds simple and it’s designed to be. FirstStep says they want you to ‘Take that first step to growing your future by investing your loose change today’.

Starting out

FirstStep is in the startup phase, they’re currently still working to get regulatory requirements such as AFS licensing, registering a Retail Managed Investment Scheme and setting up a PDS, taken care of. But they have some help with that.

The startup is being partly funded by the Sydney University’s startup program Incubate, which offers a 14-week program to startups that involves workshops, a mentoring process and pitching to investors.

Though young, there’s 12-years’ experience in finance and 8-years in web/app development the five member team. The range of experience includes a Chartered Financial Analyst (CFA), a Certified Practising Accountant (CPA), a Diploma in Financial Planning (DFP) and there’s experienced developers on-board who’ve worked on other successful startups such as ServiceLocale.

When it launches – the team is hopeful that it will launch next year – First Step will offer a web based tool, as well as Android an iOS apps. Their mobile developer Tarang, assured me that the Android app will be very much Material Design and distinctly Android in look and feel with a card based design.

Dollars and Cents

The financial side involves investment in a low cost diversified portfolio. What is that?

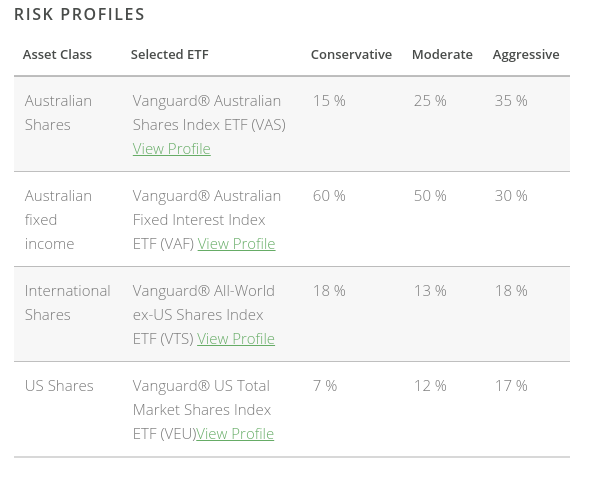

FirstStep will invest your contributions into a combination of four Exchange Traded Funds (ETFs). ETFs are financial instruments that are traded on the stock market. They track broad asset classes. The chosen ETFs we use track the Australian share market, Australian government bonds and the US and world stock markets.

It sounds complicated, but it’s not they assure me and that’s part of FirstSteps long term goal, to educate people in investment. They want to provide information on what is actually going on with your money in the investment across the ETFs.

There’s varying levels of risk involved with investing, that’s not going away, but there will be three levels of investment types – conservative, moderate and aggressive – to attempt to mitigate the risks at least somewhat.

There will be a fee on your investment, but the proposed fee structure of 1% p.a for accounts under $2000 and 0.5% p.a for accounts over $2000 is minimal and cheaper the competition.

Their back-end technology to access the big 4 banks in Australia is protected by ‘bank-grade security’, and they are confident in the security from that aspect. App encryption will be end-to-end using 2048-bit SSL Security and data stored on their systems uses AES-256 encryption. Even the FirstStep team won’t be able to see your bank credentials, it’s all hidden.

Get on board

FirstStep is still getting their product together for launch, but you can show you’re interested by registering your name on their mailing list. To encourage people to register their names, the FirstStep team is offering the first 1,000 users on the app a $5 starting balance.

There’s a lot of promise here, the FirstStep website looks professionally done and the team behind FirstStep are professional, are passionate about their product and speak with great knowledge about the product and what they intend to offer their customers.

There’s competition in the space, but with cheaper fees and an Australian made focus, the FirstStep product is one we’ll be watching with keen enthusiasm.