It’s been just over two months since Android Pay has launched in Australia, and my hasn’t that gone quickly. It’s time for a bit of a retrospective. Is Android Pay still in daily use or has it been relegated to the bottom of the app draw with all of those games that looked like they would be fun?

I should start off by outlining my mobile payments history. I started using mobile payments with CommBank when they offered what amounted to a tiny credit card you glued to the back of your phone. I then graduated to their Android App, first with Debit and then with Credit Card support over time.

I used that system typically when I had adequate time to prepare the phone. To use most payment apps you need to pull out your phone, unlock the device, navigate to the payment app, launch the app, type in a pin code, and then you’re ready to pay. That’s just 5 steps, some with great lag! In short, I used it infrequently and mainly because I really really wanted to, not because it was convenient.

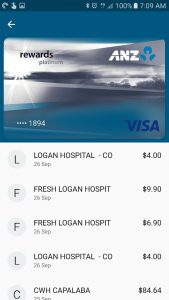

Jump forward to Android Pay, I could see the promise and added security of Android Pay, sure I had to change banks but I’m not one to be dictated to by what amounts to the warehouse for my money, I’m pro-choice, especially my choice. So, good bye CBA and hello ANZ. What’s in a few letters anyway?

In September, is Android Pay a forgotten fad or a daily companion? Was it worth the relatively low hassle of switching banks? The answer, I now use Android Pay almost exclusively for payments, but there are some caveats to that. The big issues are spotty American Express tap-to-pay acceptance, having multiple cards and loyalty card scanning.

First things first, I have setup both a Visa and an American Express card. They are both issued by the same bank and both ‘link‘ to the same account, I just get more points with AMEX, so I typically set it as my primary card.

American Express issues

Unfortunately, it seems many places that accept American Express don’t have POS hardware that is capable of accepting American Express tap-to-pay. I find this with both the physical bank issued cards and mobile apps, so the issue is not restricted to mobile payments.

What’s the solution? Well I could just stop using American Express but then I wouldn’t get my bonus points, and that would limit my choice. So I end up having to memorise all of my regular shops if they use American express, and if it works or not with tap-to-pay. I still get caught at the register with a business I don’t know, or haven’t remembered, can’t handle AMEX tap-to-pay.

Overall it’s a nuisance, especially if the machine needs to be reset, and I’ll normally just pull out my card and use the Chip, gotta get those points.

To be clear, this is not an issue with Android Pay, or with tap-to-pay in general. This is some issue of old or incompatible hardware that despite the vendor accepting American Express their EFTPOS machine isn’t up to it.

Over time this issue will hopefully improve. Already several stores I shop in have got new machines and they now accept American Express tap-to-pay. In the meantime, it could be a barrier for those who are a little less understanding about living at the bleeding edge of technology.

Multiple payment card issues

OK, now we’ve got over incompatible readers and chosen to memorise the technological infrastructure of every store we shop at, what’s next? The joy of multiple cards. By default, Android Pay will use a nominated, and easily changeable default card for payments.

To maximise my points I use the AMEX as default, so when I get up to the register to pay I need to ask ahead of time do you take AMEX? If they do I’m good to try (see point one) if they don’t I need to open the app and either switch the default card or tap open the VISA so the payment will be processed on that.

Not a huge deal, but also maybe not as easy as just pulling out the second card, but also not that much more difficult. If you’re a dual card wielding points Jedi you are more than likely already used to the card shuffle, so this is just the digital equivalent of that.

When I’m not sure and I’m prepared I just have the app open ready to change the card as needed

There can be a little lag sometimes, but then again I often had troubles pulling out my middle credit card! If you only have one payment card you’ll never experience this. If you have more than the one card then you’re already used to juggling cards.

To be honest, this isn’t a flaw with the platform, it’s just a little less easy to do digitally than in the ‘real world’

Loyalty Card issues

Why should loyalty card affect payments you ask? In actually they don’t however, I have found that about half of the scanners in shops like Woolworths Petrol (the worst offender by far), Coles etc can’t actually scan mobile phones screens most of the time.

I’ve tried LCD, AMOLED, with screen protectors and without screen protectors over the past months and years (I’ve been using an app-based loyalty card app for years – hat tip to Stocard!) and for many of these terminals nothing works.

So why does that affect my payments? If I’m going to have to pull out my wallet to get my loyalty card anyway it’s more work to then have to try and use the phone to pay, after all, I only have the two hands. As a result, I often don’t use Android Pay at these businesses, or for small purchases, I don’t use the rewards card. So the chains are missing a lot of data from me.

What needs to happen within the payments industry?

To start with the physical infrastructure across Australia, and the world needs to be modernised to accept tap-to-pay and PIN payments. 99% of the issues I have had are with AMEX, so it looks like they are carrying the majority of that burden, at least in Australia. Considering the state of payment technology in the USA this is not really surprising.

Rewards and loyalty systems either need to be integrated into platforms such as Android Pay so that you receive your loyalty bonus/ discount simultaneously with payments. At the least, the POS systems need to be upgraded to be able to reliably read phone screens. As the world goes more mobile this need will only increase.

So where does that leave me? For me, I am an avid fan of technology and more than willing to put both mental and physical effort into living on the so-called bleeding edge. I bounce back and forth between having my Visa set as the default for flawless payments, and my AMEX so I never ‘miss out” on any points. Neither is a perfect solution to my set of perhaps self-inflicted issues.

That said, I am a fan of mobile payments in general and Android Pay specifically. I can categorically say that even with my comments above it works, and works well most of the time. If I only had one Visa or Mastercard then I doubt I would have experienced any issues outside of the loyalty cards.

Online and In-app payments

In-store payments are only part of the Android Pay experience, it can also power in-app payments and online payments. Setting up app billing using Android pay is both simple, and actually feels a little safer than giving a 3rd party your credit card details. By letting Google handle the tokenised payments there is a buffer between the app developer and my valuable Credit Card number.

The same goes for online and mobile web payments. To be honest I haven’t used there must but the tokenised and anomalies transaction makes it ideal for increasing your online security. I often use PayPal to pay site I just don’t want to trust with my Credit Card. However, if I could use Android Pay and have that all authenticated via my mobile that would be easier.

What do I want next?

It’s simple, I want Android Pay on Android Wear, not just a companion app but full NFC payments. Apple has had this for over a year now, so not only is it possible we know how to make it secure. I am completely at a loss as to why Google has not implemented this, could it be coming, do they not care or is it being delayed by some mystery problem?

The other thing I would like to see, but know I never will, is a centralised loyalty wallet. Instead of my signing up to 100 different loyalty programs, so they can get hacked and leak all of my data, is a cross-platform loyalty program that let me enrol in a business loyalty program from my account.

Think Google Sign in but in the real world. This, of course, is never going to happen, your data and tracking your habits is the main reason these loyalty programs exist, that and direct marketing, so no vendor wants to share that data or be at the behest of another provider. I’ll go back to searching for unicorns I think.

Is mobile payments for you

If you’re reading this then more than likely yes, yes it is. It is both freeing and exciting to pay using your mobile device, and it is genuinely simpler if you remove the AMEX complexities. Should you change banks to get it? Hell yes you should, for two reasons. Firstly I think it’s worth it to start using, and via your data and usage, shape the future of mobile payments. Secondly, as consumers, we need to send a strong message to paternalistic banks who are putting their interests in front of consumer choice. In short, I love and use Android Pay so much my Dock got a 6th Icon.

Have you been using Android Pay? Let us know how you have found it.