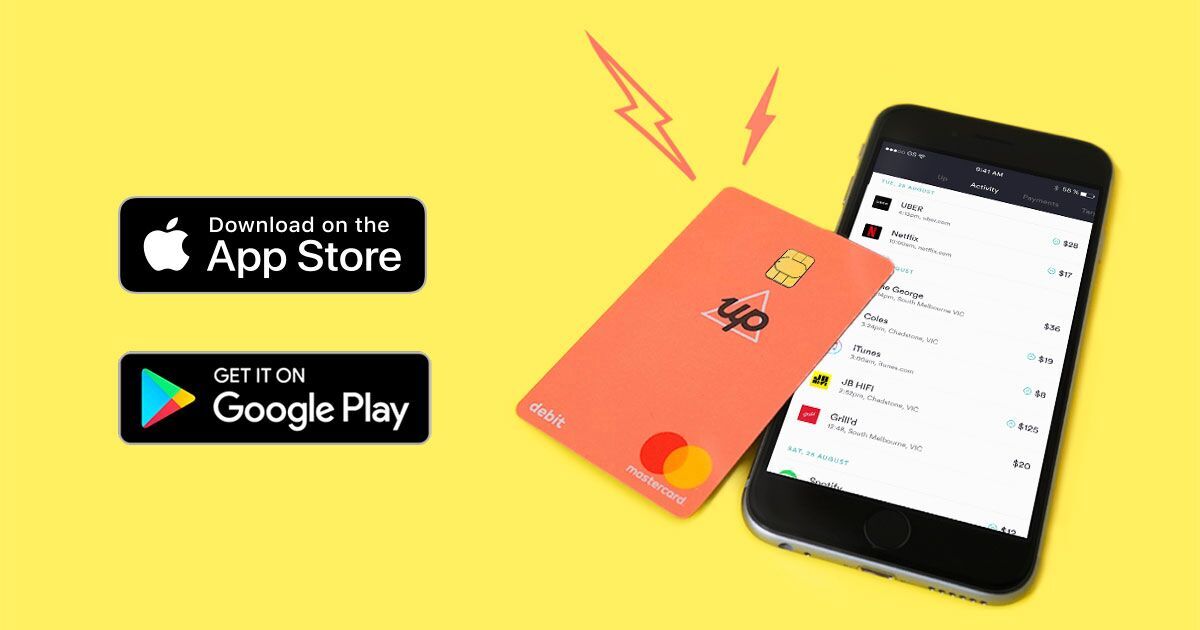

Up has launched as Australia’s first fully cloud-hosted bank, with a nifty Android app, Google Pay Support and fee-free banking part of the launch offering.

The new digital bank was launched a couple of weeks ago, but today marked the arrival of our new Up card in the mail, and so it’s now time to write about it. Not only is the sign-up and on-boarding process very easy, but activating your new card and adding it to Google Pay is a cinch!

Dom Pym, co-founder of Up, had this to say of the new bank offering:

“There’s been a lot of chatter about new-age banking alternatives arriving on the market. But the team has just been focused on actually getting one live. Up exists to simplify peoples’ lives and help them to create financial freedom through technology, innovation and creativity. We are immensely proud of the enhanced customer experience that will help people spend wisely and save effortlessly,” says Ferocia and Up Co-Founder, Dom Pym.

What’s so good about Up? Here’s the pitch:

- Naked Truth: See when, where and how you spend your money with complete clarity – time of day, clear merchant ID, location, automated weekly spend tracking and spending analysis – e.g. how much you’ve spent at one shop in the last year or from month-to-month.

- Kill Bills: Up predicts upcoming charges automatically, pays them on time, automatically generates reports to help you budget, and can show you how much you’re spending with a provider in one click.

- Life Savers: Get more out of life with 2.75%[2]interest on savings in multiple saver accounts (and you can name them with your goals). Save with round-ups on purchases, with no monthly transaction fees, or minimum deposits.

- Roam Free: No international purchase fees online or in-store, and no need to transfer money back and forth between multi-currency accounts. NB: There are currently charges on international ATM cash withdrawals and enquiries.

- Digital Native: Smart instant push notifications, second-to-none security, and Siri integration are just some of the innovations released so far. Up will take a ‘Tesla’ approach – constantly updating its products, features and benefits and sharing them with early adopters to test, and then regularly releasing to all customers automatically.

- Backed by the Best: Including Bendigo and Adelaide Bank, which provides the licensed financial products. Up also works with Mastercard for payments, and Google Cloud Platform for hosting (as the first cloud-hosted bank in Australia).

That’s not all though. Unlike most of the incumbent banks, which have dragged their heels literally screaming into the modern age, Up launches with a digital-first perspective. Up offers both Apple Pay and Google Pay to begin with, as well as Garmin and Fitbit Pay too. There’s also no fees for using any ATM in Australia.

Up has achieved something that a lot of the promised digital banks as yet have not – it’s launched in 2018. Most others have applied for restricted banking licences which take quite some time to approve, and in the meantime, they effectively cannot trade. By partnering with Bendigo and Adelaide Bank, Up is able to launch sooner, with credibility and standing behind it.

New users can register for Up today. I signed up just over a week ago, and was approved for a new account within a day or two. Your new Up Mastercard comes in the mail after about a week, and you can activate it immediately (in the app) to use with Google Pay straight away.

The only downside? With a name like Up, searching for the app on the Play Store is bound to end in frustration. Best bet? Don’t search for “Up”; search for “Up Money” and it’ll come up straight away.

https://play.google.com/store/apps/details?id=au.com.up.money&hl=en